FIDO Alliance Details Agenda for Authenticate 2023, Featuring Keynote from Rachel Tobac, Noted White Hat Hacker & SocialProof Security CEO

3-day program for FIDO Alliance’s flagship event on the future of user authentication

includes 90+ sessions; Early Bird registration available through August 18

Carlsbad, Calif., August 3, 2023 – The FIDO Alliance announced its keynote speakers and full agenda for Authenticate 2023, the only industry conference dedicated to all aspects of user authentication.

This year’s featured keynote will be presented by Rachel Tobac, white hat hacker and social engineering expert whose exploits have been featured on CNN, 60 Minutes and more. Additional keynote presentations providing diverse and global perspectives on modern authentication will be delivered by speakers from 1Password, Amazon, Google, Microsoft, Yubico and others.

Authenticate 2023 will be held at the Omni La Costa Resort and Spa and from October 16-18, 2023 – with virtual attendance options for those unable to be there in person. Now in its fourth year, the event is focused on providing education, tools and best practices for modern authentication across web, enterprise and government applications. CISOs, security strategists, enterprise architects and product and business leaders are invited to register at https://authenticatecon.com/event/authenticate-2023/.

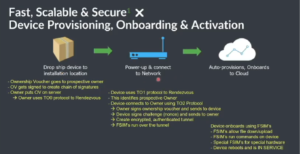

In response to its rising popularity, the conference now includes 90+ sessions from 125 speakers spread across three content tracks — as well as interactive half-day workshops for developers and user experience leads. Speakers from Alibaba Group, Fox Corporation, GitHub, Intuit, Mercari, Pinterest, Salesforce, Starbucks, Shopify, Target and others will deliver a diverse set of sessions, detailed case studies, technical tutorials and expert panels. Attendees will also benefit from a dynamic expo hall and networking opportunities whether attending in-person or virtually.

Sponsorship Opportunities at Authenticate 2023

Authenticate 2023 is also accepting applications for sponsorship, offering opportunities for companies to put their brand and products front and center with brand exposure, lead generation capabilities and a variety of other benefits for both on-site and remote attendees. To learn more about sponsorship opportunities, please visit https://authenticatecon.com/sponsors/.

There are a limited number of opportunities remaining. Requests for sponsorship should be sent to authenticate@fidoalliance.org.

About Authenticate

Authenticate is the only conference dedicated to all aspects of user authentication – with a focus on the FIDO standards-based approach. Authenticate is the place for CISOs, security strategists, enterprise architects, product and business leaders to get all the education, tools and best practices to embrace modern authentication across enterprise, web and government applications.

Authenticate is hosted by the FIDO Alliance, the cross-industry consortium providing standards, certifications and market adoption programs to accelerate utilization of simpler, stronger authentication.

In 2023, Authenticate will be held October 16-18 at the Omni La Costa Resort and Spa in Carlsbad, CA and virtually. Early bird registration discounts are available through August 18, 2023. Visit www.authenticatecon.com for more information and follow @AuthenticateCon on Twitter.

Signature sponsors for Authenticate 2023 are 1Password, Google, Microsoft and Yubico.

Authenticate Contact

authenticate@fidoalliance.org

PR Contact

press@fidoalliance.org